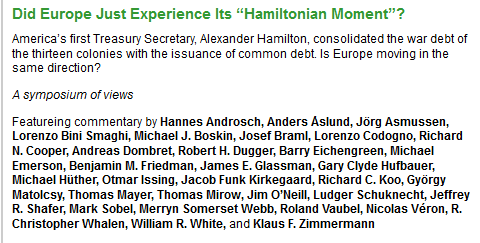

Summer 2020: Europe-wide taxation and a European finance minister are necessary consequences of the new strategy. In: A Symposium of Views. Did Europe Just Experience Its ‘Hamiltonian Moment’? The International Economy. Summer 2020. Pp. 17-18. Text see below.

Klaus F. Zimmermann: Europe-wide taxation and a European finance minister are necessary consequences of the new strategy.

After the onset of the Covid-19 crisis, European institutions remained absent for a long time, leaving relevant activities to the largely uncoordinated national policies of single governments. The European Union only returned with a coronavirus relief plan based on the issuance of common debt after a long delay.

Heavily debated among governments and within the European Parliament has been whether the mutualized debt should be provided as grants or loans, and what the negative financial implications of the rescue would be for the pre-corona European plans of fostering structural

change. But the move was also considered as a potential “Hamiltonian moment” of re-creating Europe as the United States of a zone based on fiscal and political integration.

Is such a creative leap conceivable? Can the crisis be instrumentalized to foster the needed long-term structural changes in economy and society, including establishing EU-wide fiscal stability and coordination? Simple political observation says that it pays not to waste a crisis, and no political measure is as permanent as a temporary measure. But the prospect of a new United States of Europe is not only driven by accident and the political logic of muddling-through. It is also suggested by the long-term economic forces and the immense global challenges the world is facing.

The past and future lockdowns of economies and social life will generate a tremendous recession much stronger than the global financial crisis (2007–2008), with substantial long-term negative consequences for the flexibility of government activities and government debt.

This has reinvigorated the role of government and macro management.

The burden for coming generations has substantially increased beyond the massive challenges that climate change, demographic imbalances, global refugee flows, and digitalization already present. It is almost impossible to ignore the powerful forces of globalization and international

cooperation during such an emergency.

A functioning European Union is not superfluous; on the contrary, it is more indispensable than ever. Solidarity is a global public good, but it will only be realized once common values have been agreed on, including democracy, humanitarian principles, fiscal sustainability, the

acceptance of the decisive role of incentives to optimize welfare, and the drive for structural reforms and social change.

Brexit has made this pathway easier for the rest of Europe. The critical role of the “frugal four” (Sweden, Denmark, the Netherlands, and Austria) in the debate has made the new debt policy more credible. Europe-wide taxation and a European finance minister are necessary consequences of the new strategy.

Related literature: Jo Ritzen, Javi Lopez, André Knottnerus, Salvador Pérez-Moreno, George Papandreou & Klaus F. Zimmermann (2020), “Taking the challenge: A joint European policy response to the corona crisis to strengthen the public sector and restart a more sustainable and social Europe”, UNU-MERIT Working Paper No. 2020-015.

Ends;